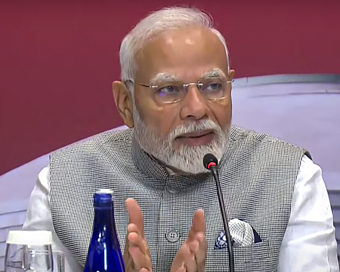

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Indian economy suffering after note ban: New York Times Last Updated : 10 Jan 2017 04:15:08 PM IST

File photo

The Indian economy is suffering following demonetisation and a shortage of cash made life increasingly difficult for Indians, the New York Times has said.

Saying the scrapping of Rs 500 and Rs 1, 000 notes "was atrociously planned and executed", the daily said in an editorial on Monday that there was little evidence that it had checked corruption.

"Two months after the Indian government abruptly decided to swap the most widely used currency notes for new bills, the economy is suffering," the Times said.

"The manufacturing sector is contracting; real estate and car sales are down; and farm workers, shopkeepers and other Indians report that a shortage of cash has made life increasingly difficult," it said.

Prime Minister Narendra Modi announced on November 8 that the high value currency that made up 86 per cent of all currency in circulation could no longer be used in most transactions and would be replaced by new 500 and 2,000 rupee notes.

Modi said this was necessary to combat corruption, black money and terror funding.

"But the swap was atrociously planned and executed. Indians had to line up for hours outside banks to deposit and withdraw cash," the daily noted.

"New notes have been in short supply because the government did not print enough of them in advance. The cash crunch has been worst in small towns and rural areas.

"The amount of cash in circulation fell by nearly half, from 17.7 trillion rupees ($260 billion) on November 4 to 9.2 trillion ($135 billion) on December 23, according to the Reserve Bank of India.

"No economy can lose that much currency in a few weeks without creating major hardship - certainly not one like that of India, where cash is used for about 98 per cent of consumer transactions by volume.

"And while a growing number of people have debit cards and cellphones that can be used to transfer money, most merchants are not set up to accept such electronic payments," the Times said.

The editorial said "there is little evidence that the currency swap has succeeded in combating corruption or that it will forestall future bad behaviour once more cash becomes available".

The government had said that people bringing more than Rs 250,000 of the old notes to banks would have to show that they had paid taxes owed on the money.

"Because of those rules, officials had expected that a lot of black money would never make it back to banks.

"Yet news outlets are reporting that Indians have successfully deposited the vast majority of old notes. That suggests that either there wasn't as much black money out there as the government claimed or that tax cheats found a way to deposit their hoards of cash without attracting the government's attention, perhaps with the help of money launderers.

"Many Indians have said that they are willing to tolerate some pain in the fight against corruption.

"But their patience won't last if the cash crunch continues and the swap does little to reduce corruption and tax evasion, as many economists predict," the daily said.

For Latest Updates Please-

Join us on

Follow us on

172.31.16.186