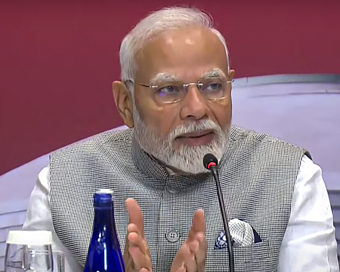

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

RIL raises $800 mn through 10-year bonds at lowest rate Last Updated : 21 Nov 2017 05:46:45 PM IST

Photo: RIL Chairman Mukesh Ambani

Reliance Industries Ltd (RIL) on Tuesday said it has raised $800 million by selling 10-year bonds in the first offering since Moody's last week raised India's sovereign rating after 14 years.

According to a Mukesh Ambani-led RIL release here, the bonds, priced at 3.66 per cent, were the lowest coupon ever achieved by an Indian corporate for a 10-year issuance, the company.

"The notes have been priced at 130 basis points over the 10-year US Treasury Note, at a price of 100 to yield at 3.667 per cent," it said.

They "will bear fixed interest of 3.66 per cent per annum, with interest payable semi-annually in arrears and shall rank pari passu with all other unsecured and unsubordinated obligations of the company," it added.

RIL will use the proceeds to refinance existing debt. India's largest company has a debt of around $12 billion (Rs 75,000 crore) on its books, a major portion of which will mature next year.

"The company will use the proceeds to redeem its existing $800 million 5.875 per cent senior perpetual fixed rate unsecured notes pursuant to the terms of such notes," it said.

The notes were oversubscribed more than 1.6 times across 90 accounts.

The statement said this was the tightest ever spread over US Treasury for an Indian entity for a 10-year issuance, as also the tightest ever spread over US Treasury for a 10-year BBB corporate issuance from Asia minus Japan since the global financial crisis.

Issued against the backdrop of the upgrade of the country ratings by Moody's, RIL successfully concluded a swift intra-day execution to capitalise on the market window, according to Joint Chief Financial Officer V. Srikanth.

"This refinancing transaction was well received by high-quality investors across asset managers, insurance companies, and banks and helped us achieve substantial savings in interest cost over the life of the notes," he said.

With the RIL rated at par with the sovereign rating, following the upgrade by Moody's of India's ranking, RIL too has been assigned a 'Baa2' grade.

Last week, US credit rating agency Moody Investor Service upgraded India's sovereign ratings to 'Baa2' from its lowest investment grade of 'Baa3' and changed the outlook for the country's rating to 'stable' from 'positive'.

It said this was based on the Indian government's "wide-ranging programme of economic and institutional reforms".

On the rationale for RIL's 'Baa2' rating, Moody's said that it reflects the company's strong ability to generate operating cash flows, with Ebidta, or operating income, exceeding $10 billion from its integrated refining and petrochemical operations, as well from its new digital services business.

IANS For Latest Updates Please-

Join us on

Follow us on

172.31.16.186