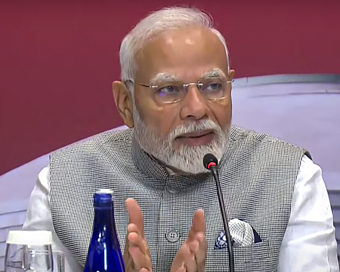

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Muted growth prompts RBI to cut key lending rate to 6% Last Updated : 04 Apr 2019 01:20:57 PM IST

Muted growth prompts RBI to cut key lending rate to 6% Muted growth and subdued inflation prompted the Reserve Bank of India (RBI) on Thursday to lower its key lending rate for commercial banks by 25 basis points (bps) to 6 per cent.

Accordingly, the lower repo, or short-term lending rate for commercial banks, will reduce interest cost on automobile and home loans, thereby ushering in growth.

The decision to reduce repo rate was taken by the RBI's Monetary Policy Committee (MPC) at its first monetary policy review of the current fiscal.

"On the basis of an assessment of the current and evolving macroeconomic situation, the MPC decided to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6 per cent from 6.25 per cent with immediate effect," the RBI said.

"Consequently, the reverse repo rate under the LAF stands adjusted to 5.75 per cent, and the marginal standing facility (MSF) rate and the bank rate to 6.25 per cent."

Additionally, the MPC also decided to maintain the neutral monetary policy stance.

"These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of + or - 2 per cent, while supporting growth."

At its final bi-monthly policy review of 2018-19 in February, the central bank's MPC voted to lower its repo rate by 25 bps to 6.25 per cent.

IANS For Latest Updates Please-

Join us on

Follow us on

172.31.16.186