Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

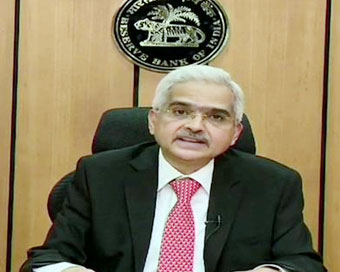

RBI cuts key rates to 4.40%, maintains accommodative stance Last Updated : 27 Mar 2020 01:47:05 PM IST

RBI Governor Shaktikanta Das (file photo) The Reserve Bank of India (RBI) on Friday massively reduced the key lending rates in response to the Covid-19 outbreak.

Accordingly, the Monetary Policy Committee of the central bank in an unscheduled meet reduced the repo rate, the key interest rate at which the RBI lends short term funds to commercial banks, by 75 basis points to 4.40 per cent from 5.15 per cent.Consequently, the reverse repo rate was also reduced by 90 basis points to 4 per cent.Besides, the marginal standing facility (MSF) rate and the Bank Rate stand reduced to 4.65 per cent from 5.40 per cent.The Apex bank instituted a moratorium on interest payments on term loans for three months. This move is expected to benefit corporates and MSMEs. Even interest on working capital loans have been deferred for three months.Furthermore, the MPC voted to maintain accommodative stance, thus opening up possibilities for more future rate cuts. "This decision and its advancement has been warranted by the destructive force of the corona virus. It is intended to mitigate the negative effects of the virus; revive growth; and above all, preserve financial stability," RBI Governor Shaktikanta Das said."We are living through an extraordinary and unprecedented situation. Everything hinges on the depth of the COVID-19 outbreak, its spread and its duration. Clearly, a war effort has to be mounted and is being mounted to combat the virus, involving both conventional and unconventional measures in continuous battle-ready mode. Life in the time of COVID-19 has been one of unprecedented loss and isolation. Yet, it is worthwhile to remember that tough times never last; only tough people and tough institutions do," he said.In addition, the cash reserve ratio (CRR) of all banks have been reduced by 100 basis points to 3 per cent of net demand and time liabilities (NDTL) with effect from the reporting fortnight beginning March 28, 2020 for a period of one year."This reduction in the CRR would release primary liquidity of about Rs 1,37,000 crore uniformly across the banking system in proportion to liabilities of constituents rather than in relation to holdings of excess SLR, Das said."Furthermore, taking cognisance of hardships faced by banks in terms of social distancing of staff and consequent strains on reporting requirements, it has been decided to reduce the requirement of minimum daily CRR balance maintenance from 90 per cent to 80 per cent, effective from the first day of the reporting fortnight beginning March 28, 2020. This is a one-time dispensation available up to June 26, 2020."On the Moratorium on Term Loans, Das said: "All commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs (including housing finance companies and micro-finance institutions) are being permitted to allow a moratorium of three months on payment of instalments in respect of all term loans outstanding as on March 1, 2020."Moreover, lending institutions are being permitted to allow a deferment of three months on payment of interest in respect of all such facilities outstanding as on March 1, 2020."The accumulated interest for the period will be paid after the expiry of the deferment period," Das said."The moratorium on term loans and the deferring of interest payments on working capital will not result in asset classification downgrade," he added.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186