Gallery

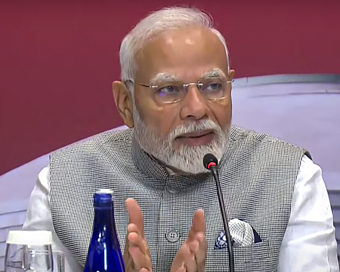

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Government introduces Taxation and Other Laws Bill in Lok Sabha Last Updated : 18 Sep 2020 11:57:18 PM IST

Parliament A taxation Bill which seeks relaxation and changes in provisions of certain Acts was introduced in the Lok Sabha on Friday amid uproarious scenes.

Introduced by Finance Minister Nirmala Sitharaman, the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020, seeks replacement of the Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020 which was promulgated on March 31 this year.The House had to witness four adjournments as Union Minister of State Anurag Thakur passed remarks against the PM National Relief Fund set up by India's first Prime Minister Jawaharlal Nehru in 1948.The Bill further seeks to amend the Income-tax Act, 1961, the Central Goods and Services Tax Act, 2017; the Finance Act, 2019; the Direct Tax Vivad se Vishwas Act, 2020 and the Finance Act, 2020 which are administered by the Department of Revenue through two boards, namely, the Central Board of Direct Taxes and the Central Board of Indirect Taxes. Thus, no additional expenditure is contemplated on the enactment of the Bill.While introducing the Bill, Sitharaman said it provides for extension of various time limits for completion or compliance of actions under the specified Acts and reduction in interest, waiver of penalty and prosecution for delay in payment of certain taxes or levies during the specified period.The Finance Act, 2020 is also proposed to be amended to clarify regarding capping of surcharge at 15 per cent on dividend income of the Foreign Portfolio Investor.The Bill also proposes to empower the Central government to remove any difficulty up to a period of two years and provide for repeal and savings of the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020.The Minister clarified that the government is not snatching the rights of any state and that "we are not violating GST council".IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186