Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

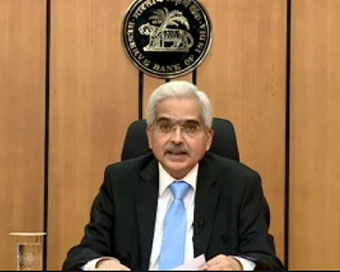

Inflationary woes: RBI retains rates, maintains accommodative stance Last Updated : 04 Dec 2020 12:46:29 PM IST

RBI Governor Shaktikanta Das The Reserve Bank of India (RBI) on Friday retained its key short-term lending rates to subdue the unabatedly high inflation rate.

However, the Monetary Policy Committee (MPC) of the central bank maintained the growth-oriented accommodative stance, thus opening up possibilities for more future rate cuts.Resultantly, MPC voted to maintain the repo rate -- or short-term lending rate for commercial banks, at 4 per cent.Likewise, the reverse repo rate was kept unchanged at 3.35 per cent, and the marginal standing facility (MSF) rate and the 'Bank Rate' at 4.25 per cent.It was widely expected that the Reserve Bank's MPC will hold rates as recent data showed that retail inflation has been at an elevated level during June.As per recent data, the Consumer Price Index (CPI), which gauges the retail price inflation, spiked in October to 7.61 per cent from 7.27 per cent in September.Though not-comparable, India had recorded a retail price inflation of over 3 per cent in the corresponding period of previous year.The RBI maintains a medium-term CPI inflation target of 4 per cent. The target is set within a band of +/- 2 per cent.In an online address detailing the MPC's decision, RBI Governor Shaktikanta Das said: "At the end of its deliberations, the MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent.""It also decided to continue with the accommodative stance of monetary policy as long as necessary - at least through the current financial year and into the next year - to revive growth on a durable basis and mitigate the impact of Covid-19, while ensuring that inflation remains within the target going forward."According to Das, the MPC was of the view that inflation is likely to remain elevated, with some relief in the winter months from prices of perishables and bumper kharif arrivals."This constrains monetary policy at the current juncture from using the space available to act in support of growth. At the same time, the signs of recovery are far from being broad-based and are dependent on sustained policy support,"."A small window is available for proactive supply management strategies to break the inflation spiral being fuelled by supply chain disruptions, excessive margins and indirect taxes. Further efforts are necessary to mitigate supply-side driven inflation pressures. The MPC will monitor closely all threats to price stability to anchor broader macroeconomic and financial stability."Besides, Das said that India's economy has witnessed a faster than anticipated recovery and its expected Real GDP growth rate will be at (-) 7.5 per cent in FY21.He cited that several high frequency indicators have pointed to growth in both rural and urban areas."Consumers remain optimistic about the outlook and business sentiment of manufactuing firms is gradually improving. Fiscal stimulus is increasingly moving beyond being supportive of consumption and liquidity to supporting growth-generating investment," he said."On the other hand, private investment is still slack and capacity utilisation has not fully recovered. While exports are on an uneven recovery, the prospects have brightened with the progress on the vaccines.""Taking these factors into consideration, real GDP growth is projected at (-) 7.5 per cent in 2020-21, (+) 0.1 per cent in Q3:2020- 21 and (+) 0.7 per cent in Q4:2020-21; and 21.9 per cent to 6.5 per cent in H1:2021- 22, with risks broadly balanced."Furthermore, Das elaborated that RBI will take additional measures to enhance liquidity support to targeted sectors having linkages to other sectors, deepen financial markets and conserve capital among banks, NBFCs through regulatory initiatives amongst other steps.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186