Gallery

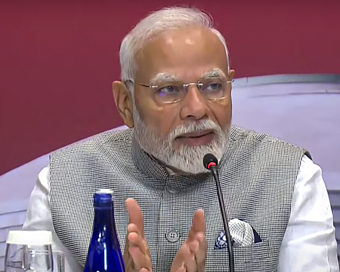

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

No rise in retail petrol/diesel prices despite new cess in Budget Last Updated : 01 Feb 2021 03:26:10 PM IST

The government on Monday imposed agriculture and infrastructure development cess at the rate of Rs 2.5 per litre on petrol and Rs 4 per litre on diesel to mobilise additional resources required for massive investment required in these two key segments of the economy that hold the key to bringing back the country on the path of growth.

However, to prevent the additional cess from impacting the retail price of two petroleum products that have already reached historically high levels across the country, Finance Minister Nirmala Sitharaman announced that rates of basic excise duty and special additional excise duty on petrol and diesel are being reduced from the existing levels.Overall, while the agriculture and infrastructure cess will raise the level of taxation on the auto fuels, reduction in excise duty will make the taxation proposal in the budget tax neutral that would keep oil marketing companies away from raising the retail price of petrol and diesel based on the new imposition.The rise in petrol and diesel prices is on hold for the last five days, but before that it had risen 10 times in January with the two auto fuels increasing by Rs 2.59 and Rs 2.61 per litre respectively this month. Petrol continues to be available at new record high of Rs 86.30 a litre in Delhi while diesel is available in the city at Rs 76.48 a litre. The high retail price in the country is despite the global crude price at $ 55 per barrel, a lot lower than $ 80 a barrel in October 2018 when petrol and diesel prices had first reached historic high levels."The current rate of taxation of petrol and diesel is the prime reason for its high retail prices now. Government should have given a thought to this and reduced taxes so that auto fuels prices remain under check. High prices of fuel have a multiplier effect and impacts pricing of various segments and aids inflation," said an industry expert asking not to be named.In the budget proposal, while agriculture and infrastructure development cess at the rate of Rs 2.5 per litre on petrol and Rs 4 per litre on diesel has been levied, government has reduced basic excise duty (BED) on petrol from Rs 2.98 a litre to Rs 1.4 a litre and special additional excise duty (SAED) from Rs 12 a litre to Rs 11 a litre. Similarly, for diesel BED has been reduced from Rs 4.83 a litre to Rs 1.8 a litre and BAED from Rs 9 a litre to Rs 8 a litre.Minor correction in retail prices even after this change is expected to be absorbed by oil marketing companies keeping consumers from any further increase in petrol and diesel prices.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186