Gallery

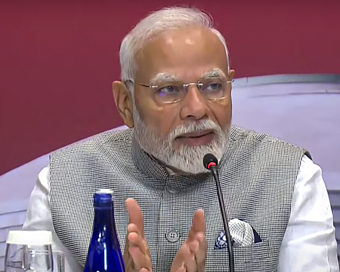

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

Stock Market Update: Sensex tanks 1,200 pts, Nifty around 16,900 dragged by realty, IT, pharma Last Updated : 27 Jan 2022 11:55:03 AM IST

The Indian equities fell well over one per cent in early trade on Thursday after the US Fed's Federal Open Market Committee said that it was ready to tighten monetary policy through rate hike.

In its latest meeting on Wednesday, the Federal Open Market Committee kept its policy interest rate "near zero" and stated its expectation that an increase in this rate would "soon be appropriate.""The Committee also agreed to continue reducing its net asset purchases on theschedule we announced in December, bringing them to an end in early March," the US Fed's Chairman Jerome Powell said at the post-meeting press conference.At 10.25 a.m., Sensex traded at 56,879 points, down 2.00 per cent or 1,278 points, whereas Nifty at 16,890 points, down 1.9 per cent or 307 points.Since the start of the year, the benchmark indices have fallen around four per cent, much of it was led by fund withdrawal by foreign institutional investors.Among the stocks, Titan, HCL Technologies, Wipro, Tech Mahindra, and Hero Motocorp were the top five losers in the morning session.Cipla, Axis Bank, ONGC, and Bharti Airtel, on the contrary, were some of the top gainers.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186