Gallery

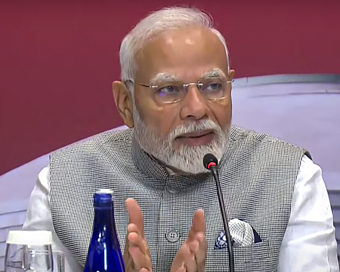

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)India Open Competition in Shotgun, organised by the National Rifle Association of India (N

- Hockey India names Amir Ali-led 20-man team for Junior Asia Cup

- Harmanpreet Singh named FIH Player of the Year, PR Sreejesh gets best goalkeeper award

- World Boxing medallist Gaurav Bidhuri to flag off 'Delhi Against Drugs' movement on Nov 17

- U23 World Wrestling Championship: Chirag Chikkara wins gold as India end campaign with nine medals

- FIFA president Infantino confirms at least 9 African teams for the 2026 World Cup

SBI Life, HDFC Life shares jump on reports of likely delay in LIC IPO Last Updated : 02 Mar 2022 09:01:52 PM IST

Shares of SBI Life Insurance Company and HDFC Life Insurance Company rose sharply on reports of a possible delay in the much-awaited initial public offering (IPO) of Life Insurance Corporation of India.

SBI Life shares settled 5.7 per cent higher at Rs 1,120, whereas HDFC Life 7.0 per cent up at Rs 560.In an interview with Hindu BusinessLine, Union Finance Minister Nirmala Sitharaman said if "global considerations" warrant any delay, she wouldn't mind looking at it again.LIC had on February 13 filed the Draft Red Herring Prospectus (DRHP) with capital markets regulator SEBI, looking to sell the Centre's 5 per cent equity stake in the company via IPO route.The Centre aims to offload a total of 316 million equity shares to investors through the public offering of the 6.32 billion outstanding shares, the DRHP document showed.The Centre wishes to conclude the IPO by the end of FY22, and it would like to cash in on the LIC IPO to meet its revised divestment estimate.The current fiscal's divestment target was revised to Rs 78,000 crore from the Budget estimates of Rs 1.75 lakh crore.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186